It happened… DJIA at 20,000. Another milestone conquered. Now what?

Basically a milestone is just a number but a round one, like 1,000 or 10,000 or 20,000 etc. As a round number has no significance from fundamental view: The fundamentals don’t change if DJIA rises to 20,000 or to 20,050 or 20,100 or drops at 19,950 etc. Those numbers are very nearby and the fundamental situation of the market and overall economy doesn’t change in a few days or even months.

But a round number has significance from the psychology aspect. How can influence the situation? With two different ways. I explain:

#1. It could boost market’s rise: enthusiasm prevails in the crowd; after all, a milestone conquered. Bulls are strong! The references of the media create a positive ‘environment’. Many people increase their positions in the market or new money enters in the market – demand increased and strengthen upward trend.

#2. This milestone’s conquest, can push many market participants to reconsider their thesis. Besides, the valuations are high and if it is to sell, then this moment, around the milestone’s conquest ‘positivity’, seems to be appropriate. Remember that it’s not the number of participants that moves the market but the absolute amount of money. So if some big players (with very big portfolios) decide that this is an opportunity to sell high and during euphoria, then the money outflows from the market, will be bigger than the money inflows that will come from many small players. Supply will overcome demand and prices will decline. May be, market will enter to a downward trend.

What will happen? Time will tell. No one can know for sure. The environment is very complicated and no prognostication can be done. For me, valuations are very high and the market has uncertainties and risks. But these are not fresh news. My view is this one, since the late of 2015 – and during 2016.

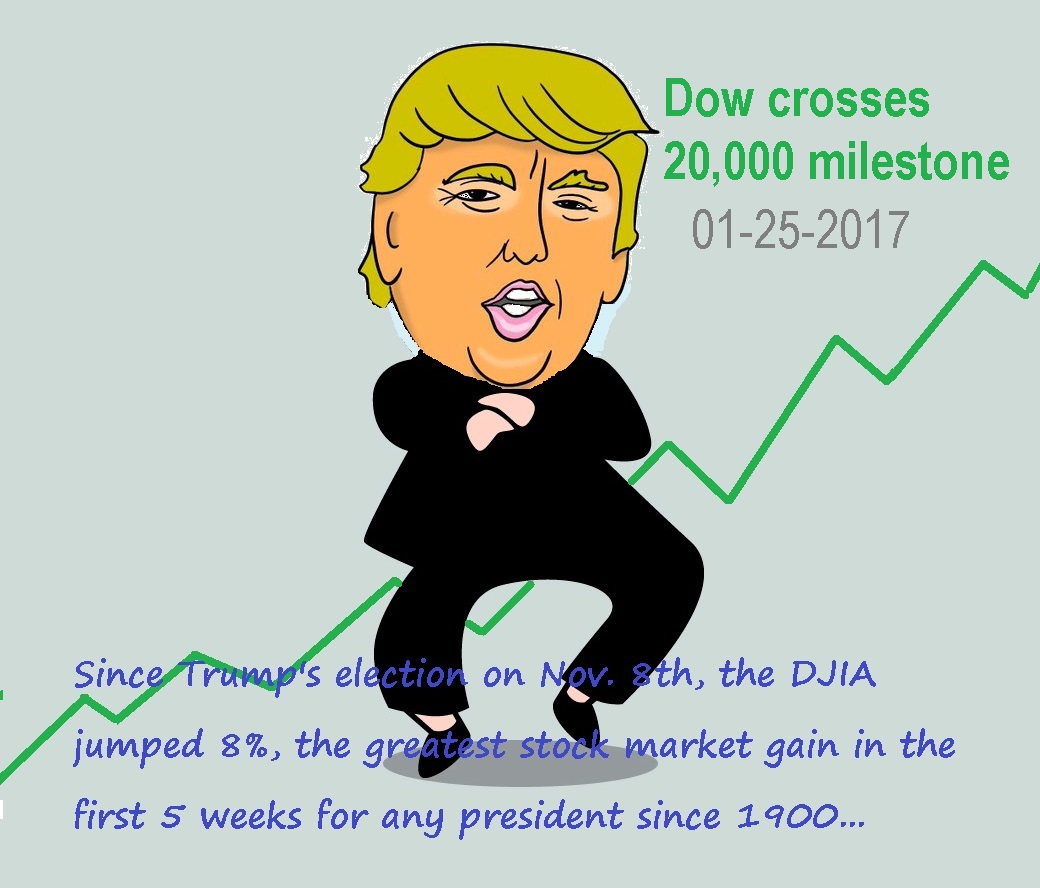

Another – maybe important – observation is that President Trump, claims credit for Dow’s milestone. This is not good and wise for Trump. Because if someone claims credit for the rise, then consequently and indirectly, accepts responsibility also for the fall.

Panayotis Sofianopoulos

Author of HERETIC INVESTOR