As Benjamin Franklin said, An investment in knowledge pays the best interest! Knowledge is the most powerful weapon and nobody can take it from you. Imagine now, how precious is the knowledge that makes you wealthy.

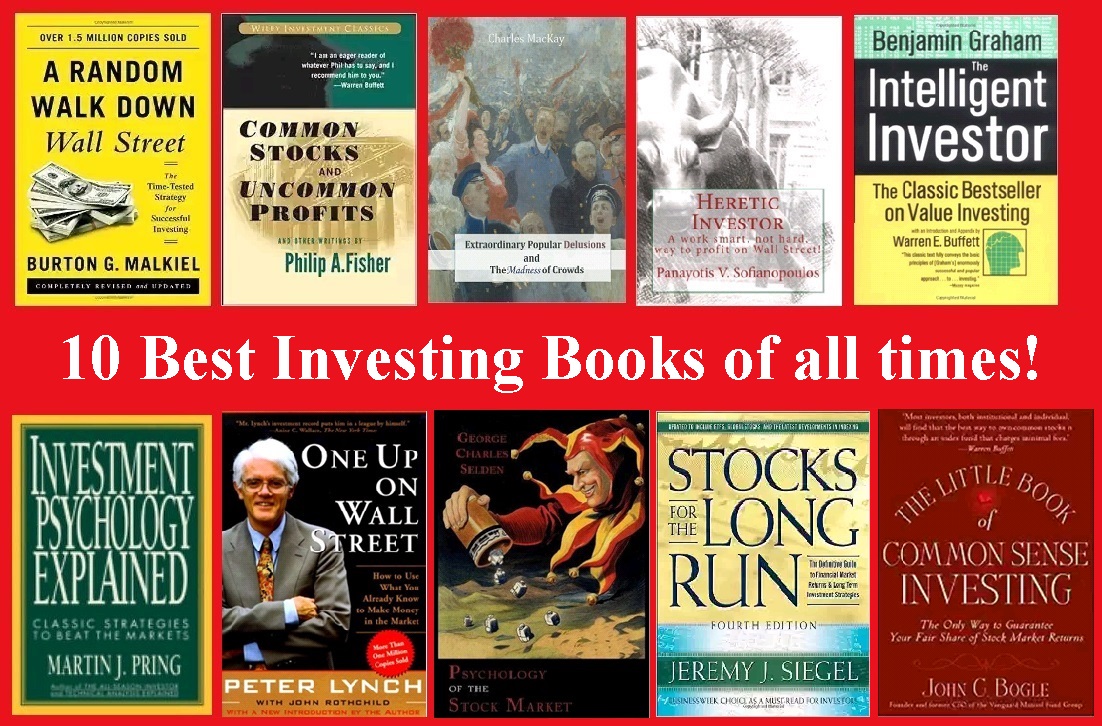

After reading a few dozen books on investing, we chose the top, the crème de la crème and now we present them to you. We chose known and not known, old and new. The criterion was their usefulness and not simply to be famous. Some old books are awesome but they don’t have the appropriate marketing… The same occurs for the new books that are from ‘fresh’ authors, not known yet. Those books combine cumulative experience and knowledge of the last two centuries till today and we suggest you, read them all, because each one, is valuable and in many cases, they are complementary one to another.

However, it is a ‘paradox’ that investors do not read and although much things are known, since they are written in the books, the investors ultimately learn by pain, in other words by the mistakes they make. Isn’t it foolish, since many of the mistakes could have avoided if they had read?

Anyway, now we did the filtering for you. Further, consider these books as a gift option, as a good book has great value, no expiring date and everyone will appreciate such a gift.

Here the List, alphabetically ; Enjoy it!

A RANDOM WALK DOWN WALL STREET, by Burton G. Malkiel

Awesome book, it’s a great intro into the world of investing for finance novices. This book popularized the ideas that the stock market is efficient and that its prices follow a random walk. Essentially, this means that you cannot beat the market. Professor Malkiel makes a strong case for sensible investing choices using index funds and ETFs. Like any good academic, Malkiel backs up his argument with lots of research and statistics. He includes overviews of the financial, economic and psychological foundations for stock markets, as well as entertaining summaries of the history of stock markets in U.S. and the world.

Malkiel describes how risky various investments are, describes a variety of specific investments (e.g. index funds, individual stocks, your own home) and suggests how individual investors should mix them, depending on their personal circumstances.

Find it on amazon.

COMMON STOCKS and UNCOMMON PROFITS, by Philip Fisher

This book is written by Philip Fisher, who Buffett credits partially for his success. In the age of quantitative finance, this book is a must-read for those who want to understand how to inspect a company qualitatively. It’s remarkable that Fisher’s investment philosophies, introduced about 50 years ago, are studied and applied and by today’s financiers and investors. The updated paperback retains the investment wisdom of the original publication, plus the perspectives of the author’s son Ken Fisher, an investment guru in his own right in an expanded preface and introduction. The famous Warren Buffett, the great investor, said: “… by using Phil’s techniques…enables one to make intelligent investment commitments.”

Ph. Fisher searches for “growth stocks”, companies with superlative management (superior sales force, superior research and development, clear focus on the business) and he holds their stocks ‘forever’.

Find it on amazon.

EXTRAORDINARY POPULAR DELUSIONS AND THE MADNESS OF CROWDS, by Charles Mackay

Markets are driven by crowd’s psychology. This book is an old book but classic and reference in this field. Originally published in 1841, shows that economic bubbles have existed long before the modern stock markets. The book describes among others, famous bubbles such as the Tulip Mania, The Mississippi Company, The South Sea Company, and Mackay provides plenty of information and explanation into how humans have committed financial folly over time. Although the book is of 19th century, don’t forget that history repeats itself. Someone that will study the cases and behaviors, can understand how crowd behaves all the times. This can be very helpful, to recognize the bubbles and you can save yourselves from market plunges that can be proved disastrous for your wealth.

Find it on amazon.

HERETIC INVESTOR, by Panayotis Sofianopoulos

An amazing new book (released in 2016). We were impressed. It’s really heretic, as it challenges the current markets’ dogmas and even tests the area of abundance attraction. The book describes how stock markets work, how can be even chaotic in short to mid-term, but rational long-term. Analyzes the basic parameter of psychology and argues that someone that wants to be successful in stock markets must be long term investor. Also gives tools and techniques that help you buy low and sell high. It has many examples and graphs. Sofianopoulos mentions the major mistakes that you must avoid in order to win. Also describes how to outperform market professionals and achieve a return, equal or bigger than the benchmark, using a mix of passive and random investing.

Find it on amazon.

INTELLIGENT INVESTOR, by Benjamin Graham

It’s a classic. First published in 1949. Benjamin Graham is known as the Father of value investing and was the mentor of Warren Buffett, the best investor of all time, that you can find him every year in the Top 5 of Richest people globally on Forbes List. Buffett, in the Preface of 4th edition, has called The Intelligent Investor “by far the best book on investing ever written”. This book is not for traders and speculators and will not tell you how to beat the market. But this book will tell you how to minimize the odds of fatal losses, how to maximize the chances of achieving sustainable profits, how to control yourself from behaviors that prevent investors to reach their full potential. In 2003, Jason Zweig, a well known WSJ financial columnist, updated the book with his own commentaries and footnotes.

Find it on amazon.

INVESTMENT PSYCHOLOGY EXPLAINED, by Martin J. Pring

Psychology is the main driver of market movements; so someone that understands psychology of the crowd, can be a successful investor or speculator. This book describes that there is no easy way in the stock markets, there is no Holy Grail, points out that emotions cloud sound judgement. It mentions many common mistakes traders often made and many pitfalls to avoid. Martin J. Pring emphasizes the values of hard work, patience and self-discipline and giving examples of many great investors’ investment attitudes.

Find it on amazon.

ONE UP ON WALL STREET, by Peter Lynch

Peter Lynch became known in the 1980s as the manager of the well known actively managed mutual fund, Fidelity Magellan. The One Up On Wall Street, is a practical guide of how to use what you already know to make money in the market. The book is following a common sense approach, which insists that individual investors, if they take the time to do their homework, can perform just as well or even better than the market Pros. The book describes the power of common knowledge (take advantage of what you already know), that you don’t have to be a Wall Street analyst to discover investment opportunities, you are not disadvantaged against big Funds, you don’t have to accurately predict the stock market to make money in stocks and to keep an open mind to new ideas.

Find it on amazon.

PSYCHOLOGY OF THE STOCK MARKET, by G. C. Selden

This little book (92 pages) was written in 1912 and is based upon the belief that the movements of the markets, are dependent to a very large degree on the mental attitude of the investing and trading public. It is remarkable how well it analyzes in simple and understandable manner, how the psychology functions in stock markets. Basically, if someone has hidden its publication year, no one could understand that it’s an old book. So we have a timeless book. If you apply its directions, you will be able to pass through market dangerous conditions and storms, untouched. And this is a basic condition for someone to be a successful investor, speculator or trader.

Find it on amazon.

STOCKS FOR THE LONG RUN, by Jeremy Siegel

Very insightful financial book that gives you information on why or how the market works. An excellent book for quantitative thinkers. Professor Jeremy Siegel demonstrates that stock returns outperform all other investment alternatives, on the long run. The book is probably the best summary of the historical data on investing, some of the data go back to the early 19th century. It indicates the importance of diversification, as also that small cap value stocks provided superior returns historically ; it also gives a trading strategy, the correlation of stock markets growth with inflation.

Find it on amazon.

THE LITTLE BOOK of COMMON SENSE INVESTING, by John Bogle

Jack Bogle, the Father of the index fund, helped revolutionize investing by creating in the 1970s the remarkable option of passive investing. Bogle has written many books, but this one, contains a lifetime of wisdom. Successful investing is not easy. It requires discipline and patience – but it’s simple. For it’s all about common sense. The book demonstrates why you don’t have to waste time and money in individual stocks and why is better and successful investment option, the index funds. The book has solid advice and quotations. It is easy to read, has lots of examples and diagrams. Overall, it’s a great and insightful read.

Find it on amazon.